As we wind up the year, I wanted to share an update on the current local Los Angeles Real Estate market. I have been hearing people talk about what they think is going to happen and some who have said that they think that the market will implode and crash!

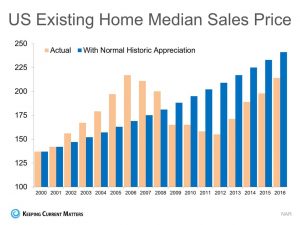

Please understand, we have not gone from a good real estate market to a bad real estate market. We have gone from an abnormal market to a normal market. The abnormal market was where there was only one month of inventory, interest rates unusually low, almost all homes on the market got multiple offers, and prices went up every month.

A normal market has a healthy amount of inventory and buyers have choices. It is more important than ever to hire an agent with skill and experience! How can I be of service to you?

Warmly,

Revi Mendelsohn, Realtor | The Mendelsohn Group Rodeo Realty Beverly Hillscell/txt: 310-963-7384fax: 310-388-1101Click here to book a phone appointment with Revi

[email protected]www.TheMendelsohnGroup.com5 Star Zillow Reviews

BRE#01461233

Click the icons to find us on Facebook, Instagram, and Twitter!